What is a Budget?

- Learning for Life and Work

- Jun 4, 2020

- 4 min read

Updated: May 15, 2025

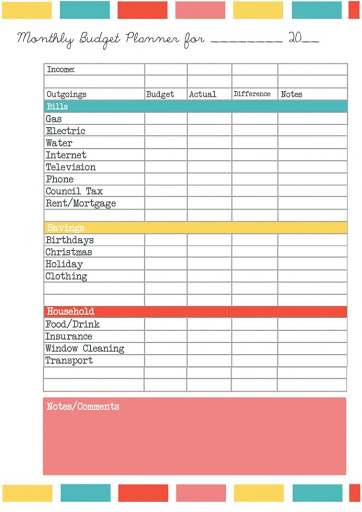

A budget is a way of managing finances. It is a money plan used to balance income to the house/business (money coming in) and expenditure (money spent). A budget should be reviewed regularly on a weekly, monthly or yearly basis.

How can a person stick to a budget?

Creating a budget requires honesty of all of the money coming in and naming where all the money going out is going to, e.g. bills, mortgage, petrol for the car, food.

Why is setting a budget so important?

Setting a budget gives a person or a business a better understanding of their finances.

Setting a budget ensures that the money that has come in, say through wages in a household, will last until payday. This helps the person avoid debt and having to borrow money from friends or family.

Setting a budget allows the person to live within their means thereby being able to balance living costs against their income.

Setting a budget creates money awareness with the realisation that bills such as electricity and heating must be paid and taken into consideration with setting a budget.

Setting a budget provides a person with the opportunity to save money/invest money which can be used for luxury items such as a car, holidays, new clothes.

Setting a budget provides a person with the opportunity to save money in case of emergencies in the future, e.g. such as heating breaking down in winter, or the car needing fixed.

Setting a budget prevents a person from impulse buying, items such as clothes or other luxury items, as they will know how much money remains to be spent on their budget and if they can afford to buy these items.

Sticking to a budget can be difficult and requires a good understanding of the budget set and determination to stick to the budget.

A person can stick to their budget by:

Being realistic

When sticking to a budget it is important to understand that whatever the income is, there is only a certain amount of money to spend. It is also important to understand all of the spending that is required for that amount of money, sometimes this means cutting back on things so that the person has enough money for bills.

Prioritising their spending

When sticking to a budget it is important to prioritise spending from the most important to the least important. The most important spending should include bills such as mortgage, electricity bills, food and least important could be a takeaway or new item of clothing that is not necessary.

Being self disciplined

When sticking to a budget it is the hard but important to be self-disciplined. It can be easy to fall into a trap of overspending on one thing and cutting back on something else. This may work on occasions but if it becomes a regular habit then it can be very difficult sticking to the budget and a person may go over their budget and end up in debt.

Keeping their budget up-to-date

When sticking track of spending on a daily basis, this can help a person keep their budget up-to-date as they are checking it everyday and this helps them to keep focused on their goals and sticking to their budget.

Considering quality compared to price

When sticking to a budget, a person may consider buying items that are cheaper in price as better quality items tend to cost more. However, it is important to research items to see if they are getting good value for money as they may end up paying for/buying a cheaper item twice as it does not last as long as a more expensive item.

Allowing for treats

When sticking to a budget it is important for a person to allow within the budget, some money for socialising, going out for a meal, buying something new. This helps the person stick to their budget and yet feel that they are not depriving themselves of nice things.

Staying motivated

When sticking to a budget, it is important for a person to keep their goals in mind, managing their money and trying to avoid debt. This will help to keep them motivated and achieve any goals they want to achieve.

What are the consequences of poor budgeting?

A person may fall into debt.

A person may need to use their bank overdraft and so face overdraft charges.

A person may not be able to pay for all of their bills and face fines or late payment fees.

A person may face possible eviction if they have not left enough money to pay their rent.

A person poor credit rating if they are unable to repay credit card debt and this can make it difficult for them to apply for loans in the future.

A person may face bankruptcy.

A person may have what they own, house, car, furniture, repossessed.

A person may experience mental health issues, worrying about not having enough money or not being able to afford basic needs.

A person may experience relationship issues as they struggle with their finances.

A person may find themselves borrowing emergency/short term loans - possibly putting them into more debt.

QUESTIONS YOU COULD BE ASKED:

Explain the term 'budget' (2marks)

A budget is a money plan used to manage finances by balancing income (money coming in) and expenditure (money going out).

Write down two advantages of budgeting. (2marks)

It helps a person manage their money so they can pay all their bills on time.

It allows a person to save money for future needs or emergencies.

Describe two advantages of sticking to a budget. (4marks)

Sticking to a budget helps a person live within their means, ensuring they do not spend more than they earn, which reduces the risk of getting into debt. (2marks)

It allows a person to save money for future needs or emergencies, such as a broken boiler or unexpected car repairs, giving them financial security. (2marks)

Write down two consequences of poor budgeting. (2marks)

Unable to pay bills

Getting into debt

Explain two consequences of poor budgeting (4marks)

Poor budgeting can lead to unpaid bills, which may result in fines, late payment fees, or even eviction if rent or mortgage payments are missed. (2marks)

It may also lead to increased stress and mental health problems, as the person worries about affording basic needs and managing their finances. (2marks)

You should also read:

Comments